Macro Long/Short EW Managed Futures Methodology

Run your own Macro L/S Managed Futures Book Easily... Fairly Easily

Before Intro:

This is the 1st time I’ve put together anything like this. I’m aware that maybe it won’t make much sense. I’m trying to write the madness of my own mind. Bare with me please, I’ll get better at it and make more adjustments as necessary. Please ask any questions, it’s possible I made a mistake as well even though of course I try not to. If there’s decent interest, I’ll release the excel sheet so you can do this really easy and look through it. That may make it make more sense I hope.

Intro

I’ll post the following heatmap as I feel this is a good quick way to understand how and what we’re going to be doing here. Furthermore, some of you may have already seen it from my prior, albeit basic post on this. First, look at the tickers we’re trading. Don’t use the Etf’s to run this, short fee’s on some are horrible. Second, look at the columns and understand there’s short term and interm trends etc. Third, understand Breakout/Down and Mean Reversion are here as well. Fourth, the final weights aren’t equal weight. I will go into all of these and I will keep it easyish. I’m kind of a generalist in nature, so while I build these, I also don’t like these super convoluted quant subs that make me feel like a donkey.

Tickers

The current managed futures strategy I trade has more tickers than this and the weighting scheme is different as well. However, 1, it’s a pain to manage, 2, the notional values are high, 3, I won’t give out the weighting methodology behind it, 4, maybe a simpler strat does better and can save me time and stress.

I won’t go into the data or studies on the following. You can ask ChatGpt and it will give a more in-depth answer. However, there are plenty of data and studies out, including one from JungleRockCapital formerly WifeyAlpha on X. Those studies will show that you can generally capture most of the macro movements with only 10 assets. Those assets are above in the heatmap. I added 1 extra and that is Natural Gas. Why? Because I think Nat Gas is a strong macro driver, further I believe that Oil does not do a good job replacing this. You may take it out if you wish, or any of the above. However, I think Nat Gas while take an increasing importance macro wise.

Conclusion: With 10-11 Assets you can capture most of the macro market movements. The extra’s are just in fact extras. An example of this is Cocoa. No portfolio built this way would have Cocoa in it. You would entirely miss out on that meteoric rise last year. However, the argument here is, Cocoa is not a big macro economic driver anyway. Maybe for some countries that produce it sure, but overall macro, no one cares about Cocoa.

Short Term and Interm Trends and Strengths

I will get to the weighting parts last. Understanding everything first is important. We have both Short Term and Interm Trends. Short Term is based off the last 51 Days, and this encompasses variety of signals I won’t release. Interm is based off 151 Days of Signals Data.

Both Short Term and Interm make up 50% of the portfolio for a total 100%. Told ya, I’m making it donkey proof for generalist like me 😂 Why use, both? The reason to use both is also simple. You don’t want to be in a strong interm trend at a high weight, when the short term trend is breaking down and vice versa. This gives you diversification of signal and that is of great significance.

You can look at DBMF during the SVB Crisis. They were heavily short 2’s. They mostly use interm signals from what I gather, and have no mitigation for breakouts/downs or anything else. Merging all these, decreases your overall Volatility within the strategy and reduces signal whipsaw.

Signal Value Codes For Trend and Strength:

Trend: 4,3,2,1,0,-1,-2,-3,-4. 0 Signifies no Trend at the Moment signal wise. Anything positive signifies a positive trend and anything negative signifies a negative trend.

Strength: Same Values as Trend. Where 0 Signifies Chop. Anything positive has positive trend strength and negative has negative trend strength.

These signal numbers are important, because they will be classified to give increase or decrease in weightings, as well as weather something is long or short, or no position at all.

Mean Reversion and Breakout/Down Signals

I’m including this in this section as it makes more sense. The Mean Reversion and Breakout/Down Signals are all based on the Short Term Time Frame as well ONLY. This will make more sense later during the weighting methodology. However, just understand, that these are ONLY on Short Term Time Frame Signals.

Let’s take the Breakout/Down (BO/BD From now on) Signals first. Again, these are signaled on the Short Term Time Frames. You can ONLY get a BO Signal if and only if on the Short Term Time Frame the asset is in a negative trend. Vice Versa, you can ONLY get a BD Signals when the trend is positive. That’s it. The reason for this is because we’re looking for every chance to decrease elevated weights, Long Or Short, when a trend may be beginning to mean revert. I hope that makes sense.

BO/BD Signal Classification: If it’s +1 That’s a BO Signal from a Negative Trend. If it’s -1 That’s a BD Signal from a Positive Trend. Again we’re trying to search here for trend changes. A quick example of this not saving us, but helping substantially, was again during SVB. Of course everyone was short 2’s. And why were they short them in such size, well because Vol on 2’s is quite low and their generally diversified against other assets in the book. So you size them higher and models do as well. A Breakout Signal got us trimmed on our Bond Positions by over 25% and Mean Reversion ones helped as well during that time frame. There is value here. Now on to Mean Reversion.

Mean Reversion

This again is only signaled on the Shorter Term Time Frame. Why? Because I’ve found purely based on Vibes that this does work better. No, honestly it does. Things tend to mean revert faster on this time frame than on the interm one. As well as interm trends can continue stretched for longer. Again this is either +1 which is when we expect mean reversion to the upside when something gets stretched too far on downside. Vice versa we have -1, which is when something gets stretched too far to the upside.

I lied, if you hopefully are paying attention to the heat map, there is 0.5 and -0.5. What are these? I think you can probably take a guess. However, essentially, they are when only half the Mean Reversion Signals hit. So see you were probably right, or at least close to being right. We do it this way because simply, Mean Rev is very hard to get right. So we hedge ourselves a bit here with a half Mean Rev Signal.

Methodology for Weighting (Yes the Good Stuff)

Weighting for Short Term Trend Book

(Remember, this one encompasses, Trend, Strength, BO/BD, and Mean Reversion Signals)

1 - There are 11 Assets, 100% Overall Weight/11= 9.0909091% Equal Weight for Each Asset.

2 - Look at Short Term Trend. Forget the minus or positive. Just look at signal Value. Each current asset is weighed EW at 9.09%.

If Trend is +-4 then increase EW Weight by 0.5. So 9.09 * 0.5.

If Trend is +- 3 then increase EW Weight by 0.35. So 9.09 * 0.35.

If Trend is +- 2 then increase EW Weight by 0.2. So 9.09 * 0.2

If Trend is +-1 then increase EW Weight by 0.1 so 9.09 * 0.1

If Trend is 0 then EW Weight is now 0%. No Allocation is of course given to something with no Trend based on the Signals.

Now take those increases and put them in a separate column. We’ll add them together when finalize the Trend Strengths Methodology.

Trend Strengths Weighting Methodology -

This is similar with some differences of course. The Increases or Decreases are still based on the Original Weights. Not the already increased or decreased weights. Furthermore, here you can have a negative number with a positive trend score number. This is an important distinction as well. Let’s get into my lunatic mind shall we. You will see that a +-4 is only increased by .25 instead of .5 as well.

If Trend Strength is +-4 then we’re going to times the EW 9.09 by .25. So 9.09 * .25

If Trend Strength is +-2 then it’s 9.09 * .2

If Trend Strength is 0 then it’s 9.09 * .15. Why does 0 here actually have something happen to it. Remember this is Trend Strength and Not Score. Therefore, 0 is chop and we need to account for a choppy trend.

Make the Additions to the weights again

Anything with a positive Trend Score and a Positive Strength will have a positive number to add later.

Anything with a positive Trend Score and a Negative Strength will make that number Negative to subtract it later.

Anything with a positive Trend Score and a 0 Strength will make that number negative as well to subtract later.

Anything with a Negative Trend Score and Negative Strength will make that number positive as well to add to a short later

Anything with a Negative Trend Score and 0 Strength will make that number Negative again to subtract for Choppiness.

Adding the Trend Scores and Strengths Together

We’re going to do this simply. You have in essence 4 columns. The first being the EW’s of 9.09%. The Second being the numbers taking into account the Trend Scores. The Third being the numbers taking into account the Trend Strengths. The Fourth Column will be the final weights column.

To get the Fourth Column. Anything with a 0 Trend Score immediately gets a 0% Weighting. That’s Easy. Everything else we’re going to do this.

Column A1 EW 9.09%

Column B1 Trend Score

Column C1 Trend Strength

Column D1 = (A1+B1)+C1

Column D1 will now have the appropriate Weights for the Short Term Portfolio. We now have increased assets with Positive Trends And Positive Strengths. Increased Assets with Positive Trends and then Decreased Weights for Choppiness or Negative Strength and more.

We now make anything with a Negative Trend Score a Short Weighting and Of Course anything with a Positive Trend Score is a Long Weighting.

Annnnnddd We’re not Done (You’re Kidding me)

I know this is a bit annoying. However, it’s easy to code and easy to excel sheet it as well. We have to now take the BO/BD and Mean Reversion Signals into Account.

Now we don’t use the EW Original Weights anymore. We use the Final Long Short Weights we just arrived at.

If Weight is Positive and there is a BO/BD Signal of -1 and a Mean Reversion Signal of -0.5 or -1. Then times the final weight by 0.25 if Mean Reversion is -0.5 or 0.35 if Mean Reversion is -1.

If Weight is Positive and there’s a BO/BD Signal of -1 and no Mean Reversion Signal then Still times the Final Weight by 0.25

If Weight is Positive and there’s no BO/BD Signal but a Mean Reversion Signal of either -0.5 or -1 then times the Final Weight by either 0.15 or 0.25 Respectfully.

The Same goes for if the Final Weights are Shorts (i.e. the Weights are Negative)

This will then make sure to reduce the Longs or Shorts that were substantially increased. A further diversification for the rebalance period.

Final to do:

Then divide all those weightings by 50%. Why? Because this is only 50% of the book. The other 50% is the Interm Trends. So cut everything by 50%.

Interm Trends

This is done exactly the same as the Short Term Trends Portion, however, the only difference is BO/BD and Mean Reversion Signals do not matter here.

Once the above is done for the interm exactly like how we did with short term. You have 2 books each with 50% allocations. Therefore, just add the 2 books together now.

You now have your final Macro Long/Short Managed Futures Book. I will continue updating this throughout and the weightings as well each week when we rebalance. And we can continue tracking the performance of this going forward as well.

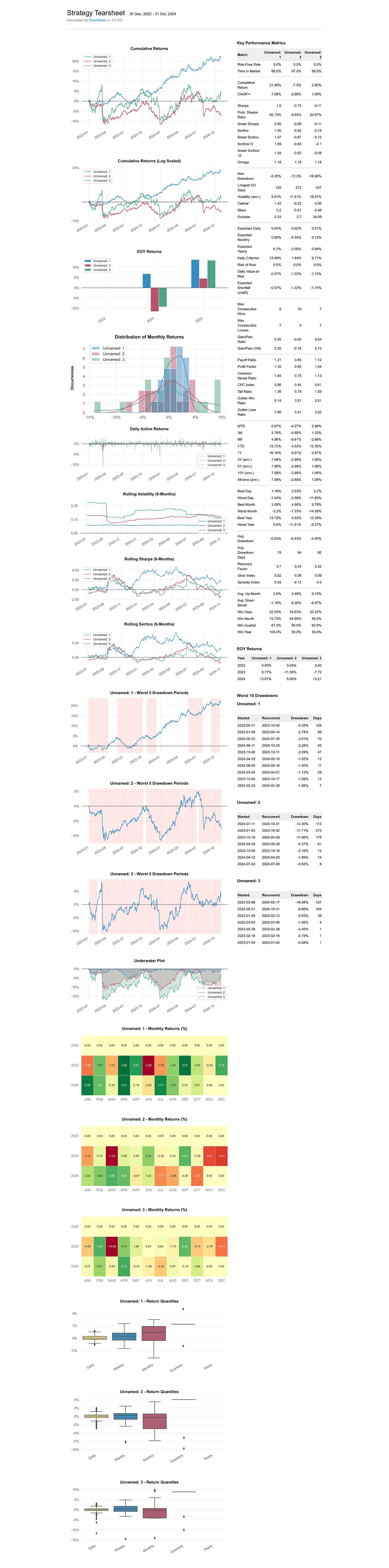

I haven’t continued to update my Managed Futures Book, with my own Weighting Algo, however, I’ll show you some performance metrics for that vs the DBMF and CTA ETF’s. Below you will find that performance tear sheet. We’re Unnamed1, It’s not bad right 😂 I think the EW, that’s not really EW, but with Overlays above, should do just as well. I do expect a few things, however, and they’re important. I do expect higher vol than my other weighted version, and I do expect a lower sharpe, and higher drawdown as well.

I do expect a positive Skew which is what we should get with any trend following managed futures strategy.

Conclusion

We now have our own Macro Long/Short Managed Futures Strategy. I can if interest, release the Excel Sheet. Also I can write up a sub regarding the futures contracts and how to allocate to those with these weights, again if there’s interest.

Lastly, this isn’t going to be some Macro Bs Sub, we have enough of those where ppl change their opinions on everything each week. We don’t need more noise around. This is just going to be signals and how we allocate to them. What I think is going to happen is irrelevant. I will make quick write ups about how the signals change etc and why. However, I’m not going to predict some Macro Narrative out of it. The narratives make for great writing, but we need to make money and have high sharpe’s. The other stuff is just noise.

This is spectacular