Boring Stuff First

These are all the strategies I run at any given time. Some I report the holdings of, and allocations. Others I don’t. The reason I don’t is, well ppl don’t pay for them lol. The weighting algo took me way too long to create and deliver alpha with. I can’t just give them away. Other’s I report the holdings all the time because the alpha is in the signal, not the weightings of particular assets.

Ok, so now you realized I’m a gatekeeping and greedy prick let’s get on to performance.

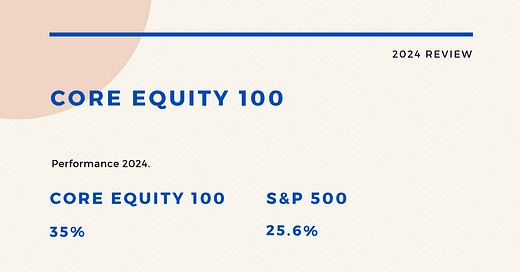

Core Equity

The last few months of 24 were pretty brutal if I’m honest. The yr was really good, except from late Oct-Dec. Still there is a bit of underperformance as ffs Mag 7 and Tech is the only game in town. Other than that, I’m pretty happy given that tech makes up less than 14% of this portfolio. Sharpe much better than S&P, returns better, yea very happy. I’ll still complain about the final months and 13 + days of equal weight S&P 500 being down. I’ll never use MSFT products again and no more tech.

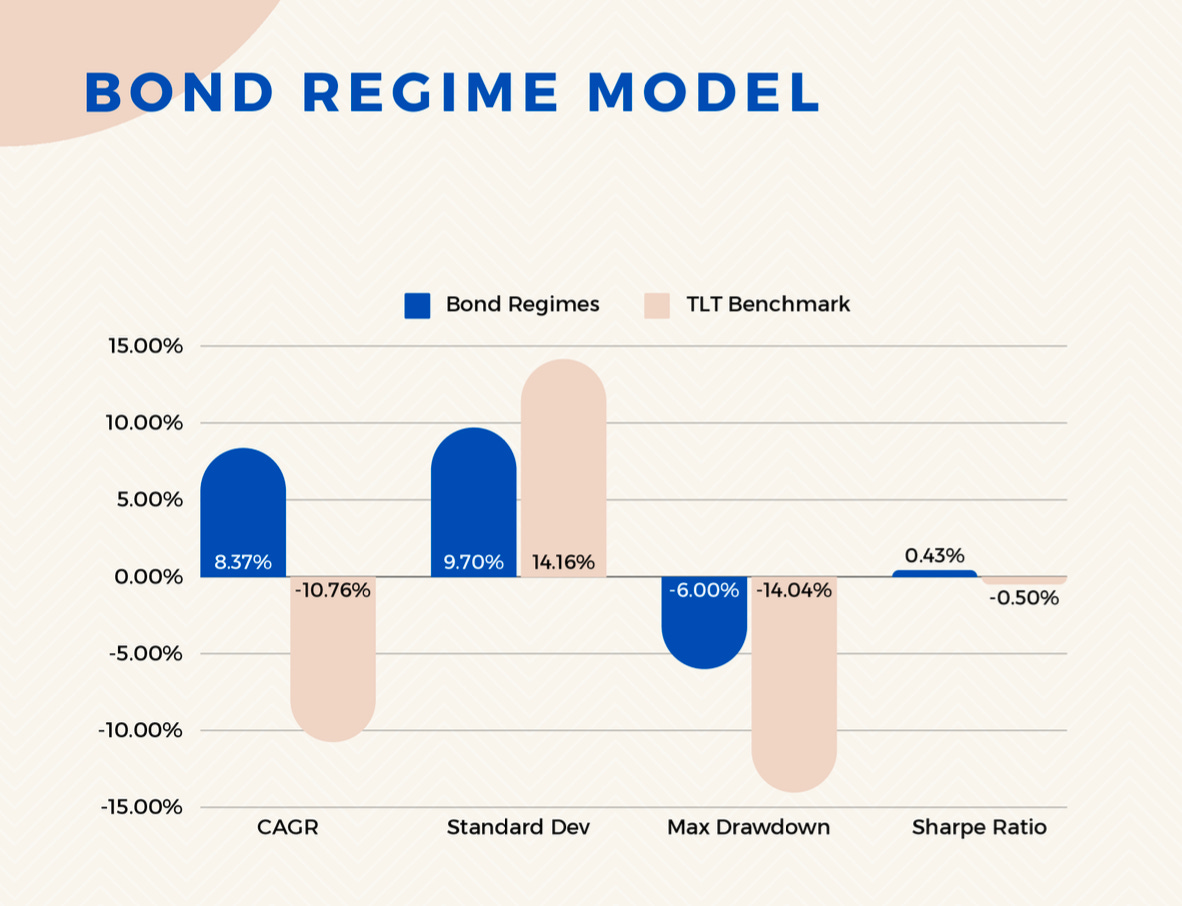

Bond Regime Model

Really happy with this in 24. It caught most of the upside moves, missed most of the downside ones and really kept me out of the bloodbath. Best of all is I share these allocations. At least I will be more, had a difficulty holiday season, but I will be more present. Let’s hope for a good 25, I don’t want another 24.

Pretty good huh 😂 I will say, right now, if bonds have good 25, I think this will underperform a bit. However, the outperformance from 22-24 has been so good I don’t mind. These regime models, generally underperform in a broad-based rally with less than 5% dd’s. We’ll see how 25 fairs for bonds, but I do think they’re attractive here and can start piecing in. This is about 50% allocated at $87.80 on TLT. The final 50% has a much higher hurdle to clear. I think some point in Jan the final 50% will allocate.

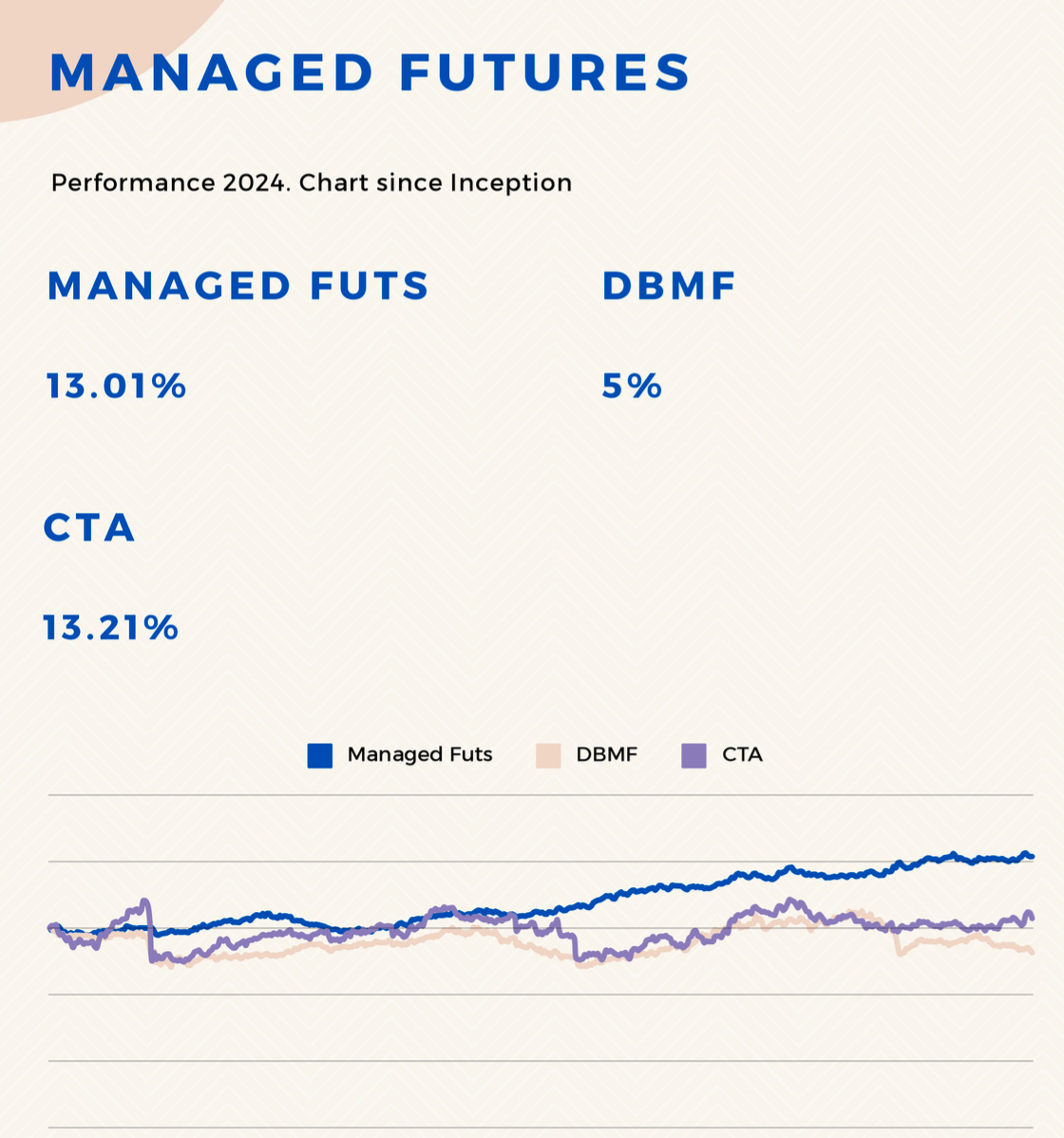

Managed Futures (Some of this is shared too)

Quick statement these are not dividend adjusted so the numbers on DBMF and CTA will differ from the div included %’s.

I again don’t share the weights for the assets within this. I do, however, share the trend signals, mean reversion signals, breakout and down sigs, and trend strength scores for all the assets within this book. Good year, I can’t complain on this. I did do a quick write up on this and a rough methodology. I think if you can equal weight the signals it should perform quite well also. I think I may do another write up on how to run this with less capital, since futures have a high notional value even in Micro’s. Can look on Twitter to see current Longs and Shorts in this book.

Long/Short Equity

I want to share this at some point. It’s pretty cool, the weighting algo, the factors, exposures and countries. It’s probably the most fun of all these, so it would be cool to share with others. Usually has over 200 holdings at any given time, so it’s hard to replicate, but I could probably do something like US Only which would be much easier and hell the US is the only market that goes up anyway lol.

Relative Value Volatility (I share the allocs for this book at eod) It’s very easy to implement

First time running anything like this. They say you get lucky on the first try so maybe every yr after this will be down. You’ve been warned. This basically at the end of each day takes a long position in front end vol and a short in mid-term vol, or vice versa. Check out

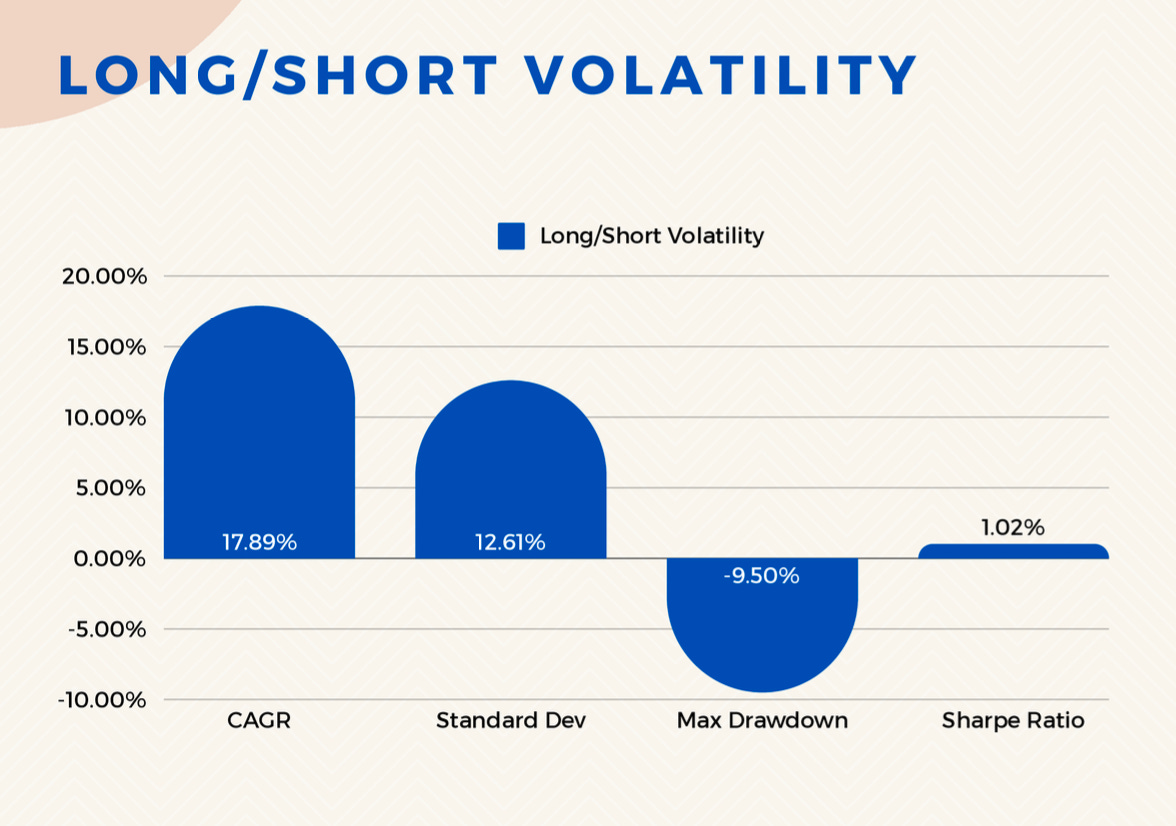

he’s the best in anything Vol and is easily one of the best reads on here. Plus, he taught me how to do this easier in IBKR, I’m a donkey and still can’t believe it’s as easy as he said.Long/Short Volatility (I share the alloc’s for this as well eod)

I hear some ppl thinking ok what’s the difference between this and Rel Val Vol. Easy, this at the end of day, will either take a long position in front end vol, or a short position in front end vol. That’s it. No mid-term or anything like that. Just front month contract.

S&P 500 Daily Risk Regime Model (Futures but can use SPY ETF if you like. I recommend using futures.) I do post the daily alloc’s for this as well.

This one did underperform in total performance, as well as Sharpe. It’s to be expected when generally there is little vol, or big drawdowns in a given yr. This is trying to reduce risk first, not put it on. Therefore, when the market dips and recovers very quickly you have a problem since it puts risk back on a bit slower than it takes it off. This isn’t necessarily a problem as I have a different model to take risk off fast and put it on just as quickly that performed better. However, this is an important model to run within the Muti Strat Regime Model, which I’ll post soon, and you’ll see the Sharpe on that even with this model here underperforming.

Aggressive Risk On/Risk Off Model S&P 500

(This one I do post daily eod as well. It will reduce risk and increase it very aggressively to sell rips and try and buy dips. Like the name implies lol. You can see the Sharpe on this is much better than the S&P 500 with much lower vol. I’d follow this one and use futures on it as well if I was you.

Multi Strat Regime Model (This encompasses the Aggressive Model Above, The Daily Model and also Rel Val Vol)

You can equal weight the above strats to get the multi strat or you can meta momentum them and allocate more to whichever one is doing better over a period of time. That’s my fav approach for these, as well as using futures to allocate to this multi strat. It’s more capital efficient and you can modestly lever if you’d like.

Final

This is most of the strategies I run during the yr. I didn’t include the Sector Regime Model, because this is getting long enough so I’d rather keep it generally short. China as well isn’t in here even though it was a good yr there for it, and finally Value strategies are not included either even though they outperformed the benchmark.

I hope this gives a generally representation of the strats I run and which ones will be shared and what you can expect from them. I’m not going to be some Macro “Guesser” or anything like that. The models spit out allocations and I follow them. I don’t care about anything else. They’re robust and have worked in sample and out of sample. The minute I start listening to outside Macro voices is the minute these all go to shit. Have an incredible 25. I wish you all a ton of love, happiness and health. I really mean that. These are numbers and make me a miserable person sometimes, but at the end while I’m losing my hair it’s probably the most fun thing you can do.